The Section 232 Investigation Could Affect Your Metal Cost & Capacity

“Which metals will get cheaper?” It’s a question OEM customers are asking even more these days in light of the latest events in the Section 232 investigation of unfair imports.

“Which metals will get cheaper?” It’s a question OEM customers are asking even more these days in light of the latest events in the Section 232 investigation of unfair imports.

It’s true that laws banning China and other countries from “dumping” their excess metal into the U.S. market could greatly impact your ability to do business in manufacturing. Let’s look at where domestic steelmakers are now and how they may soon have an easier time managing material cost and capacity.

Section 232 Investigation Recap

The purpose of the U.S. government’s investigation is to determine the effect of steel and aluminum imports on national security. But the part you care about is whether its conclusion ends in tariffs or import quotas for foreign steel or aluminum.

The U.S. Department of Commerce announced Jan. 11 it had completed its probe into imports and sent its conclusions to President Donald Trump. The climactic announcement ended up being anticlimactic, as the department gave no insight into the investigation’s results.

As of Jan. 11, Trump had 90 days to take any action on the findings.

What the Department of Commerce specifically investigated was the impact of imported pipe and tube.

Section 232 and Your Capacity

A recent Zekelman Industries article claimed pipe and tube imports increased by 70% in the first half of 2017. Overall, steel imports rose 15.5 percent in 2017, according to the American Iron and Steel Institute. It’s notable that while many see the investigation as lobbing a political grenade at China, that nation actually accounts for less than 2% of U.S. steel imports.

Still, imports of tube and pipe are robbing project opportunities from U.S. companies. American steelmakers have been arguing that imports under fair market value have undercut the business of steel mills, which could result in closings and layoffs. And the Trump administration and many metal manufacturers have pointed to China’s excess capacity of tube and pipe as the number-one problem domestically.

"Our nation cannot afford to allow the continued rise of foreign imports that undermine America’s capacity to produce the steel necessary for our country’s national and economic security,” U.S. Steel said in a statement after the government’s announcement.

Indeed, the domestic industry is operating well below “recommended capacity utilization” -- under 70%. Industry and government officials are worried about the ability of steelmakers to provide products for national security and other industries.

With the U.S. economy showing gradual improvement recently, capacity could be an issue as more companies try to build and otherwise use steel. If the government brings sweeping changes to import laws, it may be best to roll them out over 5-10 years instead of all at once. That way, U.S. manufacturers can more confidently ramp up production.

Section 232 and Your Cost

When you blend imported, low-price products with high-price domestic products into the same market, you can guess whose product suffers. Thankfully for U.S. manufacturers, expectation of a Section 232 crackdown on imports helped restore American steel prices in 2017.

If that supply tightens, the value of U.S. steel and aluminum will continue to rise.

There are a few ways to look at these potential changes by Trump’s team:

1. Metals Affected by Law Changes

Any metal that’s no longer importable (legally) would absolutely become more expensive stateside.

Some customers use steel products out of necessity, due to the physical demands of their projects. If costs go up, engineers and their bosses will celebrate (as long as they’re able to pass the price increase on to their own customers).

2. Everything Else

Copper, bronze, stainless steel, and other metals that may not be affected by the issue would seem more affordable by comparison. A more luxurious metal might not seem so bad compared to more common choices once their prices change. You might just want to spring for something fancy next time!

What’s Next?

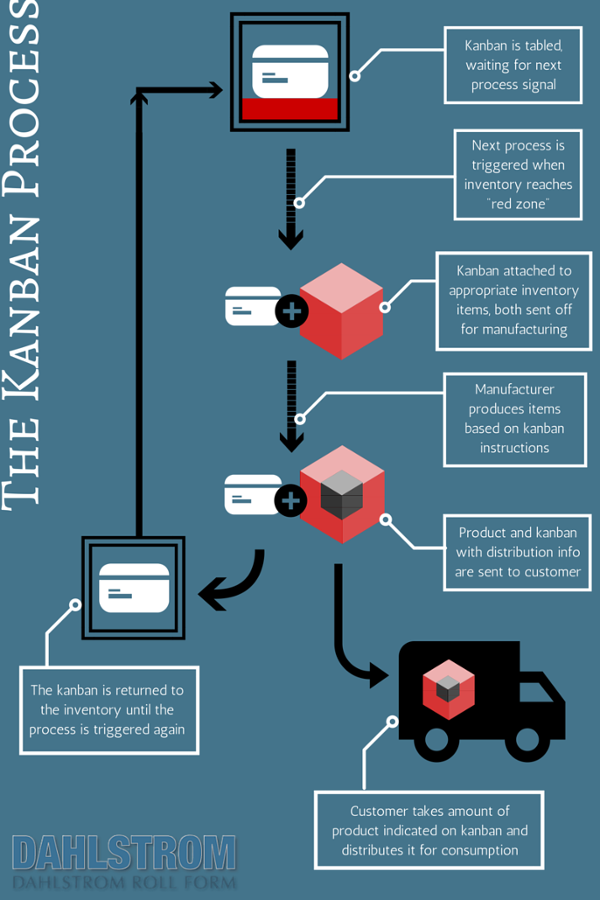

More silence, apparently. While Team Trump renders a decision, you could improve on other value-adding elements of your supply. Vendor-managed inventory, using a manufacturer that maximizes run efficiency, part design options for lower metal content, choosing the right metals … the possibilities are practically endless. If you’re concerned about roll forming costs, talk to an expert about what to expect -- now and in the future.

You May Also Like

These Related Stories

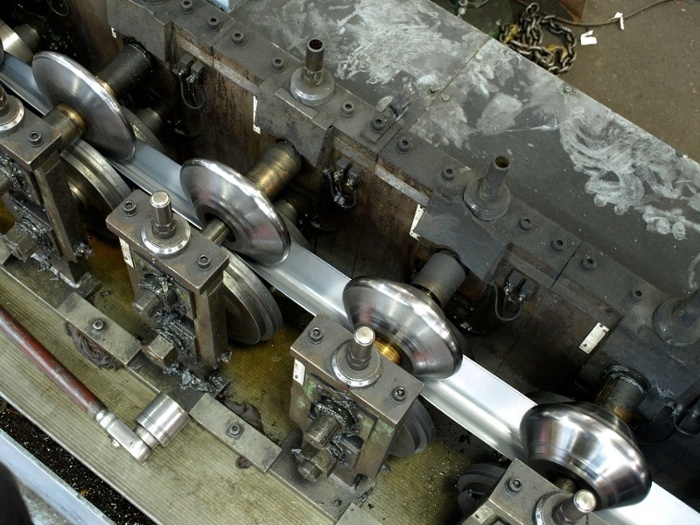

Roll Forming Advantages: Efficiency & Cost-Savings

Outsourcing Roll Forming Tooling: Cost Savings Down the Line